Research suggests that two-thirds of people had a legal need in the past four years.[1] When you have a legal need, especially a contentious one, you may need to use a Barrister. Barristers are experts who can stand up in court on your behalf or provide you with specialist advice. Even if you haven’t personally used legal services, the actions of Barristers matter to you. This is because Barristers play a vital role in the functioning of our legal system, which impacts all of us by ensuring that we can protect our rights as citizens and hold each other to account.

Barristers are regulated by us at the Bar Standards Board. We work to ensure Barristers, and the market in which they work, operate in the interests of the public. We do this by promoting objectives set in the law when we carry out our work. [2]

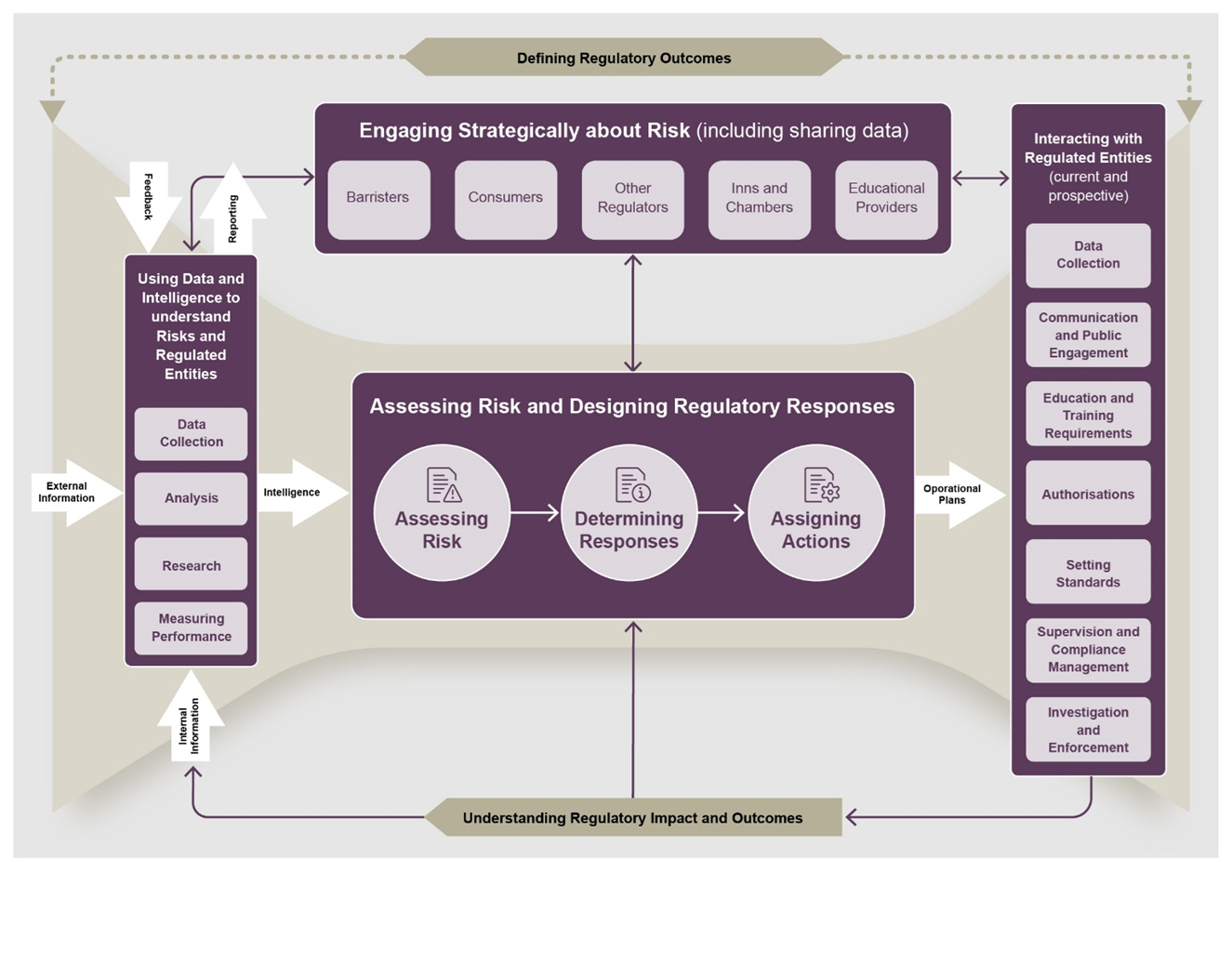

To carry out our work effectively, the BSB operates as a risk-based regulator. This means we prioritise our work according to the harm that may arise if Barristers or the market for their services fail to serve the public interest or support our objectives. We call this ‘regulatory risk’. We identify and address these risks to ensure that Barristers and the market for their services function properly, thus ensuring we can promote the objectives.

We act as a risk-based regulator by understanding barristers and the market for their services, so that we can make the right decisions. Once we understand the key risks, we have various tools at our disposal to address them. These include communicating directly with the public and profession, conducting inspections, and if necessary, changing our rules. We also set the requirements for becoming a barrister, and, when someone’s conduct falls below what is expected, we will take action to alter or remove an individual’s right to be one.

Most of these activities involve engaging with the barristers we regulate and their businesses, but we also work with groups such as training providers, legal consumer organisations and others involved in the sector.

This approach to identify and responding to risk is called a regulatory risk framework. We explain in more detail our current risk framework on our website.

[1] Two in three people have legal problems, but many don’t get professional help - The Legal Services Board

[2] In exercising our regulatory functions, we promote the regulatory objectives of the Legal Services Act 2007. There are a number of objectives including but not limited to promoting the public interest, supporting the rule of law, protecting consumers, and improving access to justice. These can be found on our website.

In late 2022, we decided we should look again at our regulatory risk framework. We initiated an internal review that would assess the effectiveness of our risk framework and activities, and identify ways to make them better by looking at best practice.

Throughout 2023, we carefully examined our risk framework, speaking to our staff, other regulators, and carrying out research to understand current best practice. We found that certain things about our framework worked well. Our approach uses robust risk methods and makes the risks we identify clear to everyone through our risk index. We also have a well-developed culture of understanding what risk is, a significant achievement as research has shown it can take years to build such a culture.

However, we also identified clear areas for improvement. Our internal risk management processes can be overly complex, which may hinder our ability to effectively respond to emerging or hard-to-define risks. Additionally, the quality of the data and intelligence we use to assess risks varies- some parts of the BSB’s approach are sophisticated, while others are less developed. This inconsistency is a concern because reliable data is crucial for a regulator in managing risks to the public interest effectively.

To address the findings of the Review, we are taking steps to enhance our framework. This will better support the needs of the BSB and the public we serve in the coming years. We aim to build on our strengths and enhance areas we were currently fall short. We plan to do this in three main areas.

Firstly, we plan to simplify how the framework works internally. We will make our processes to gather and evaluate risks easier to understand for our people. We want our people to spend more time identifying and understanding risks to the public, including emerging ones, and less time carrying out risk exercises that may not directly alter our approach.

Secondly, we want to make sure we have better data and intelligence to drive our decisions about risk. We need to ensure that we can analyse risk well, and that this analysis informs our decisions. We have already made significant progress in understanding what we need to do with our Data and Intelligence Strategy

Lastly, we will make other improvements in how we approach risk. We will seek to explain more clearly how our regulatory risks relate to the regulatory objectives. We want to introduce clearer decision-making principles for how we select what wider risks to address (those risks that are not individual cases), and better evaluate the effectiveness of the tools we use to treat these risks.

We will implement our plans across two years up until 2026. In the first year, we will focus on simplifying and streamlining our internal approach to risk. In the second year, we will focus on how we communicate and approach risk from a strategic perspective. Because improving our data and intelligence is critical and complex, this will be considered in both years and beyond.

We will provide updates on our work here, so our stakeholders can see our progress. We are measuring our progress against six objectives, which are:

- Proactive management

- Establishing a risk framework that as best as possible anticipates and seeks to address regulatory risks before they occur.

- Data-driven Decision Making

- Risk decision making is driven by clear, up-to-date data and intelligence.

- A dynamic approach

- Having the flexibility to quickly adapt and understand different regulatory risks, and to develop strategies in response to changing conditions.

- Enhanced stakeholder Confidence

- Building trust with internal and external stakeholders through sophisticated risk analysis, transparency and engagement in risk management questions.

- Empowered Staff

- Creating an environment where staff are confident and knowledgeable, and have the tools they need to address regulatory risk.

- Clear and Agile Communication

- The Risk Framework is supported by regular, and clear, communication to stakeholders.

At the end of the first year of our Risk Framework Review implementation, we’ve made strong progress toward our ambition of becoming a best in class, risk-based regulator. Our work so far has focused on strengthening how we describe our risk framework, sharpening our use of data and intelligence, and embedding risk thinking more deeply into our decision-making culture.

We’ve made our risk framework clearer, more purposeful, and easier to act on. By reframing risk more around the public interest, we’ve shifted our lens to better align with our purpose and more closely tie in with the regulatory objectives. Regulatory risk now plays a central role in strategic planning, which sets a foundation for a more proactive and responsive approach across the BSB.

To support faster, more informed responses, we’ve invested in data and intelligence. Alongside our Data and Intelligence Strategy , we’ve developed new information products to present risk insights in clearer and in more actionable formats, enabling teams to use intelligence more effectively in their work. We’ve also brought in dedicated roles to monitor risk intelligence continuously, and increased and consolidated our internal analytical skills with a new empowered Regulatory Risk and Insights team.

Risk is also becoming a more visible part of how we make decisions at all levels. We’ve introduced and renewed our staff meetings across the BSB that empower junior people and middle managers to engage meaningfully with regulatory risk. At the governance level, we’ve improved how risk is reported to the Board and its committees, ensuring a clearer and more strategic dialogue around risk.

We know there is more to do. We need to ensure the changes above are embedded as thoroughly as possible. We want to introduce clearer decision-making principles for how we select what wider risks to address (those risks that are not individual cases), and better evaluate the effectiveness of the tools we use to treat these risks.

This is our plan for our second year of implementation. As we move into the next phases of the project, we’ll continue refining our approach to risk, to ensure it meets our objectives of being dynamic, data-driven, and firmly focused on the public interest.