You are required to complete the AtP renewal process through MyBar. During the process, you will be asked to:

- update any personal details;

- verify your practising details;

- declare the appropriate income band for the purposes of setting the appropriate fee,

- update your insurance information;

- declare your practice area information;

- make the declarations required for Youth Court work and the Money Laundering Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 ("the Regulations") and immigration supervision;

- make a declaration of truth; and

- select optional fees, make payment or delegate authority for payment.

You should complete the AtP renewal process by Logging on to MyBar.

BSB Update on the Claims Management question in this year's AtP

This year’s Authorisation to Practise (AtP) process contained a new question, asking about barristers’ involvement in claims management activity.

Following feedback from the Bar Council, the Personal Injuries Bar Association (PIBA) and a number of individual barristers, we recognise that the question’s framing and supporting guidance created confusion as to how respondents should answer. We would like to apologise for any confusion.

We are aware that individual barristers have taken different views on how to answer the question, and so the data will not provide the level or quality of intelligence we hoped to gather.

On that basis we will not be using the data from this question and will delete it once the AtP process is completed, at the end of April. This question will not appear on next year’s AtP.

Detailed information about AtP is contained below. If you are not able to find the information you require, please contact the Bar Council’s Barrister Records Department via their Barrister Records Support Hub.

Applying for a practising certificate

If you are making a renewal application, please log into MyBar. After logging in, you will see a banner across the top of the homepage. Towards the right-hand side of the banner there will be a ”Renew Online” button. Click this to start the renewal process.

If you are returning to practise, have been unregistered or if you are applying for your first practising certificate, please see the menu on the left-hand side of the screen in MyBar and click ”My Practising Certificate” and then click “New or Returning Authorisation to Practise”.

How we process your application

Once your application has been received, we aim to process it within three-four working days. If any additional information is required, we will email you for further clarification. Please be aware that your application will not be considered complete until payment, the returning application form and any additional information has been provided. Once your application has been reviewed by the Barrister Records Team, your practising certificate will be issued from the date it was considered complete or a later date of your choosing. You must not commence practice until you have received confirmation from the barrister records team that your application has been approved.

AtP renewal deadline – 31 March

The practising certificate year runs from 1 April to 31 March each year. Renewals must be completed by 31 March to be on time for the new practising year (in accordance with Rule S62 in the BSB Handbook).

The month of April normally serves as protection for barristers who for any reason fail to complete the AtP process by the required deadline. It should not be relied upon for usual practice and you must renew by 31 March.

Failing to complete the renewal process by 30 April

If you fail to complete the renewal process by Wednesday 30 April 2025, you will no longer appear on the Barristers’ Register and will not be authorised to practise.

It is a criminal offence under the Legal Services Act 2007 to carry on any reserved legal activities without a practising certificate.

If we have reason to believe that you are practising without a practising certificate, we will take such action as is considered appropriate.

Requirement for a practising certificate

You will need a practising certificate if you wish to hold yourself out as a barrister in connection with the supply of legal services or to undertake any reserved legal activities.

Reserved legal activities include exercising rights of audience, conducting litigation, reserved instrument activities, probate activities and the administration of oaths. ”Legal services” are defined further in the BSB Handbook.

If you are unsure whether the work you are undertaking requires you to hold a practising certificate, please contact the Bar Council’s Ethical Enquiries Service on 020 7611 1307 or email [email protected]

Using MyBar to apply for a practising certificate

Using the online portal, MyBar, is compulsory when applying for a practising certificate. MyBar will ensure a better service for you and give you more control over the data we hold about you.

Should you need to discuss alternate arrangements, please contact the Bar Council’s Records Department on 020 7242 0934 or email [email protected]

2025-26 Practising Certificate Fee (PCF)

The PCF varies depending on how much income you earned in the previous calendar year. Please see below for the 2025-26 PCF rates.

|

Band |

Income Band |

2025 Fees |

|

1 |

£0 - £40,000 |

£119 |

|

2 |

£40,001 - £60,000 |

£316 |

|

3 |

£60,001- £90,000 |

£635 |

|

4 |

£90,001 - £150,000 |

£1,154 |

|

5 |

£150,001 - £240,000 |

£1,753 |

|

6 |

£240,001 - £350,000 |

£2,377 |

|

7 |

£350,001 - £500,000 |

£2,540 |

|

8 |

£500,001 - £750,000 |

£3,213 |

|

9 |

£750,001 - £1,000,000 |

£3,399 |

|

10 |

£1,000,001 - £1,500,000 |

£3,855 |

|

11 |

£1,500,001 and over |

£4,080 |

If you are a self-employed barrister, your income for the purpose of calculating your PCF must be based on the total fees you received (your Gross Fee Income) from practice at the Bar (without VAT) during the last calendar year, 1 January 2024 to 31 December 2024, less any proportion attributed to acting as an Umpire, Mediator or Arbitrator (entered against Code O from the BMIF form).

Please note, you do not need to include any projected income for the purposes of our income declaration. You are only required to provide your actual gross fee income as set out above.

If you are an employed barrister, please declare your gross earnings for the tax year ending 5 April 2024. Gross earnings would be taken before any salary sacrifice or deduction of pension contributions. You will need to aggregate your earnings from:

• Employment

• Partnership

• Director fees

• Dividends (where arising from your services as a barrister)

You should exclude: fees earned as a judge, Commissioner, pensions paid to you, bank interest or private investment income, rental income, reimbursed expenses, travel allowances paid to you by your employer and earnings from employment other than as a barrister.

If you operate with dual capacity ie as both an employed and a self-employed barrister, then you should aggregate your gross income under each separate status according to the rules for that status.

Receiving your practising certificate

You will be emailed a PDF copy of your Practising Certificate once you have completed Authorisation to Practise and payment for your Practising Certificate Fee has cleared. Your practising certificate will not be sent to you in the post.

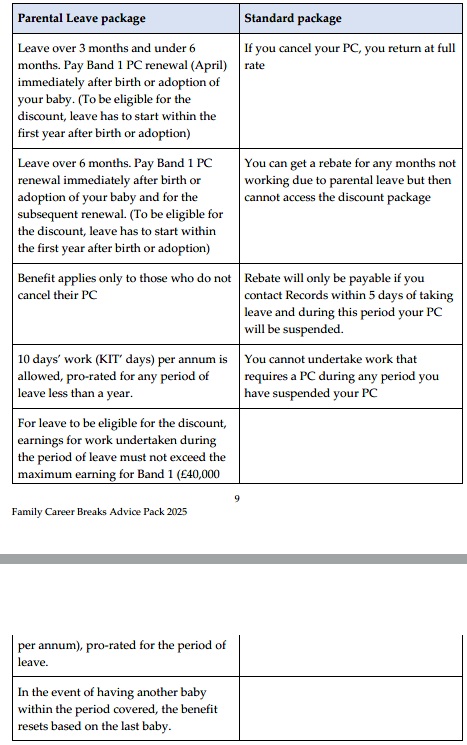

Steps have been taken to reduce the cost of a practising certificate for any barrister on parental leave and for any barrister returning from maternity and parental leave.

Band 1 is the lowest practising certificate rate and returning parents may be entitled to pay this for up to two years. This is intended to encourage you to retain your practising certificate so that you can work if you wish during parental leave including on KIT days, and to make it easier to return to work.

There are 2 options for any barrister taking maternity and parental leave:

|

|---|

Read more on the Bar Council website. If you have any questions about the application of this policy, please contact [email protected].

To change your practising status, you will need to complete the ”Change my practising status” application via MyBar. This is found under “My practising details”. An example of a change of status is changing from a self-employed capacity to an employed capacity.

You will need to review your practising addresses once you have submitted the application. These will be confirmed at the end of the process.

If you are changing your status, you are required to update your record and inform us of the change within 28 days.

If you are a pupil in your non-practising period you do not need to be authorised to practise, as you are not entitled to do anything that constitutes practising as a barrister.

If you are a pupil in your practising period, you need to have a provisional practising certificate. After submitting (i) a certificate of completion or exemption from the non-practising period and (ii) registering a practising period, you will be issued with a provisional practising certificate. This will be valid for the duration of your practising period.

Once you have completed your pupillage and confirmed this to us, you will be sent details about how to change your status to a practising or unregistered barrister, as appropriate.

If you are a self-employed barrister, an employed barrister in a BSB entity or you practise in a dual capacity, you must notify us of the chambers’/entities’ website addresses on which you offer legal services. If you operate multiple websites for your practice, please provide details of each website.

When completing AtP, you are declaring compliance for the previous CPD calendar year. This means that during the 2025/26 AtP process you will be declaring compliance for the period 1 January 2024 - 31 December 2024.

If you did not hold a practising certificate during that period, complete the declaration based on the last calendar year you held a practising certificate.

If you have not completed your CPD requirements, you will not be refused authorisation. However, you will be asked to list what action you are taking to remedy this situation. Failure to take further action to comply with CPD requirements may result in you being referred to the Supervision Department.

New practitioners are subject to a three-year New Practitioners’ Programme and therefore should select this option on the declaration. If you are unsure, please contact us using our Contact Form to check.

Self-employed barristers

If you are unable to confirm that you have insurance, you will not be authorised to practise. Please contact BMIF on 020 7621 0405 or email [email protected] to confirm whether you have cover or to arrange cover.

Self-employed barristers practising overseas

Unless you have previously been granted a waiver from this requirement, you are required to hold insurance and be a member of BMIF. Where you hold a self-employed practising certificate, you must be a member of BMIF (under Rule C76.2 of the Code of Conduct in the BSB Handbook).

Government barristers

All barristers are required to complete the insurance declaration confirming that they have and will maintain such insurance as may be required under the Code of Conduct in the BSB Handbook.

If you are a government barrister, you are not required to hold insurance, so compliance with the Code of Conduct in the BSB Handbook for you does not actually require insurance. Therefore, you will be able to complete the declaration without needing to have insurance.

Other employed barristers, providing legal services to their employer only

Although insurance is only required under Rule C76 for barristers who are providing legal services to the public, you will still be required to complete the declaration confirming you have and will maintain such insurance as may be required by the Code of Conduct in the BSB Handbook.

However, in this case, compliance with the Code of Conduct does not actually require insurance. Therefore, if you are only providing legal services to your employer, you will be able to complete the declaration without needing to have insurance.

Categories for practice area information

This year for the BMIF renewal four areas which were previously categorised separately (Admiralty, Competition, European, and International) were merged with Commercial and Financial services. We have kept these areas of practice separate, the same as in previous years, so that the information provided to the BSB is consistent across years. Outside of those four areas, all practice areas are the same as are used during BMIF renewal so in the majority of cases individual barristers will be able to provide the same information to the BSB as they provide to BMIF. This makes the requirement to provide this information less burdensome.

Practice area information for in-house barristers

We recognise that some employed barristers may advise on a huge variety of issues, covering most or all of the practice areas listed. Therefore, we have added an additional category for employed barristers - "General".

If you have selected "General", you will also be required to indicate those other BMIF categories which are most relevant. We have defined ”most relevant” as the top three categories, based on the percentage of time spent working in each area.

Requirement for registration

The requirement is for all barristers who have accepted instructions within the last 28 days to work in the Youth Court, or those who intend to do so in the next 12 months. This includes pupils in their practising period (see below).

If you have recently undertaken work in the Youth Court without expecting to do so and have not registered with the BSB to undertake Youth Court work, you should register within 28 days of accepting instructions.

If you are a barrister with a full practising certificate, you can register for Youth Court work through MyBar. If you are a pupil, you can do this by emailing [email protected]

If you require any further information about Youth Court declarations, please contact the Supervision Department by emailing [email protected]

Pupils

When you register for your provisional practising certificate, there will be a question about whether you expect to undertake Youth Court work during the practising period of your pupillage.

You should register with our Pupillage Records Team if you did not make the declaration and subsequently accept instructions for a case in the Youth Court. This can be done by emailing [email protected]

No longer undertaking Youth Court work

You should deregister if you are no longer undertaking Youth Court work and do not intend to do so in future. You can do so through MyBar.

Visit the anti-money laundering webpage for more information.