You are required to complete the AtP renewal process through MyBar. During the process, you will be asked to:

- update any personal details;

- verify your practising details;

- declare the appropriate income band for the purposes of setting the appropriate fee,

- update your insurance information;

- declare your practice area information;

- make the declarations required for Youth Court work and the Money Laundering Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 ("the Regulations") and immigration supervision;

- make a declaration of truth; and

- select optional fees, make payment or delegate authority for payment.

You should complete the AtP renewal process by Logging on to MyBar.

Detailed information about AtP is contained below. If you are not able to find the information you require, please contact the Bar Council’s Barrister's Records Department on 020 7242 0934 or email [email protected].

Applying for a practising certificate

If you are making a renewal application, please log into MyBar. After logging in, you will see a banner across the top of the homepage. Towards the right-hand side of the banner there will be a ”Renew Online” button. Click this to start the renewal process.

If you are returning to practise, have been unregistered or if you are applying for your first practising certificate, please see the menu on the left-hand side of the screen in MyBar and click ”My Practising Certificate” and then click “New or Returning Authorisation to Practise”.

AtP renewal deadline – 31 March

The practising certificate year runs from 1 April to 31 March each year. Renewals must be completed by 31 March to be on time for the new practising year (in accordance with Rule S62 in the BSB Handbook).

The month of April normally serves as protection for barristers who for any reason fail to complete the AtP process by the required deadline. It should not be relied upon for usual practice and you must renew by 31 March.

Failing to complete the renewal process by 30 April

If you fail to complete the renewal process by Tuesday 30 April 2024, you will no longer appear on the Barristers’ Register and will not be authorised to practise.

It is a criminal offence under the Legal Services Act 2007 to carry on any reserved legal activities without a practising certificate.

If we have reason to believe that you are practising without a practising certificate, we will take such action as is considered appropriate.

Requirement for a practising certificate

You will need a practising certificate if you wish to hold yourself out as a barrister in connection with the supply of legal services or to undertake any reserved legal activities.

Reserved legal activities include exercising rights of audience, conducting litigation, reserved instrument activities, probate activities and the administration of oaths. ”Legal services” are defined further in the BSB Handbook.

If you are unsure whether the work you are undertaking requires you to hold a practising certificate, please contact the Bar Council’s Ethical Enquiries Service on 020 7611 1307 or email [email protected]

Using MyBar to apply for a practising certificate

Using the online portal, MyBar, is compulsory when applying for a practising certificate. MyBar will ensure a better service for you and give you more control over the data we hold about you.

Should you need to discuss alternate arrangements, please contact the Bar Council’s Records Department on 020 7242 0934 or email [email protected]

2024-25 Practising Certificate Fee (PCF)

The PCF varies depending on how much income you earned in the previous calendar year. Please see below for the 2024-25 PCF rates.

|

Band |

Income Band |

2024 Fees |

|

1 |

£0 - £35,000 |

£109.50 |

|

2 |

£35,001 - £60,000 |

£291 |

|

3 |

£60,001- £90,000 |

£585 |

|

4 |

£90,001 - £150,000 |

£1,064 |

|

5 |

£150,001 - £240,000 |

£1,616 |

|

6 |

£240,001 - £350,000 |

£2,191 |

|

7 |

£350,001 - £500,000 |

£2,341 |

|

8 |

£500,001 - £750,000 |

£2,961 |

|

9 |

£750,001 - £1,000,000 |

£3,133 |

|

10 |

£1,000,001 - £1,500,000 |

£3,553 |

|

11 |

£1,500,001 and over |

£3,760 |

If you are a self-employed barrister, your income for the purpose of calculating your PCF should be based on the calendar year ending December 2023 that you have or will declare to the Bar Mutual Indemnity Fund (BMIF), less any proportion attributed to acting as an Umpire, Mediator or Arbitrator (entered against Code O from the BMIF form). For clarity this will be the total fees you received (your Gross Fee Income) from practice at the Bar (without VAT) during the last calendar year, 1 January 2023 to 31 December 2023. If you have been asked by BMIF to provide projected income for their 2024 renewal, do not include any projected income for the purposes of our income declaration. You are only required to provide your actual gross fee income as set out above.

If you are an employed barrister, please declare your gross earnings for the tax year ending 5 April 2023. Gross earnings would be taken before any salary sacrifice or deduction of pension contributions. You will need to aggregate your earnings from:

• Employment

• Partnership

• Director fees

• Dividends (where arising from your services as a barrister)

You should exclude: fees earned as a judge, Commissioner, pensions paid to you, bank interest or private investment income, rental income, reimbursed expenses, travel allowances paid to you by your employer and earnings from employment other than as a barrister.

If you operate with dual capacity ie as both an employed and a self-employed barrister, then you should aggregate your gross income under each separate status according to the rules for that status.

Receiving your practising certificate

You will be emailed a PDF copy of your Practising Certificate once you have completed Authorisation to Practise and payment for your Practising Certificate Fee has cleared. Your practising certificate will not be sent to you in the post.

Overview

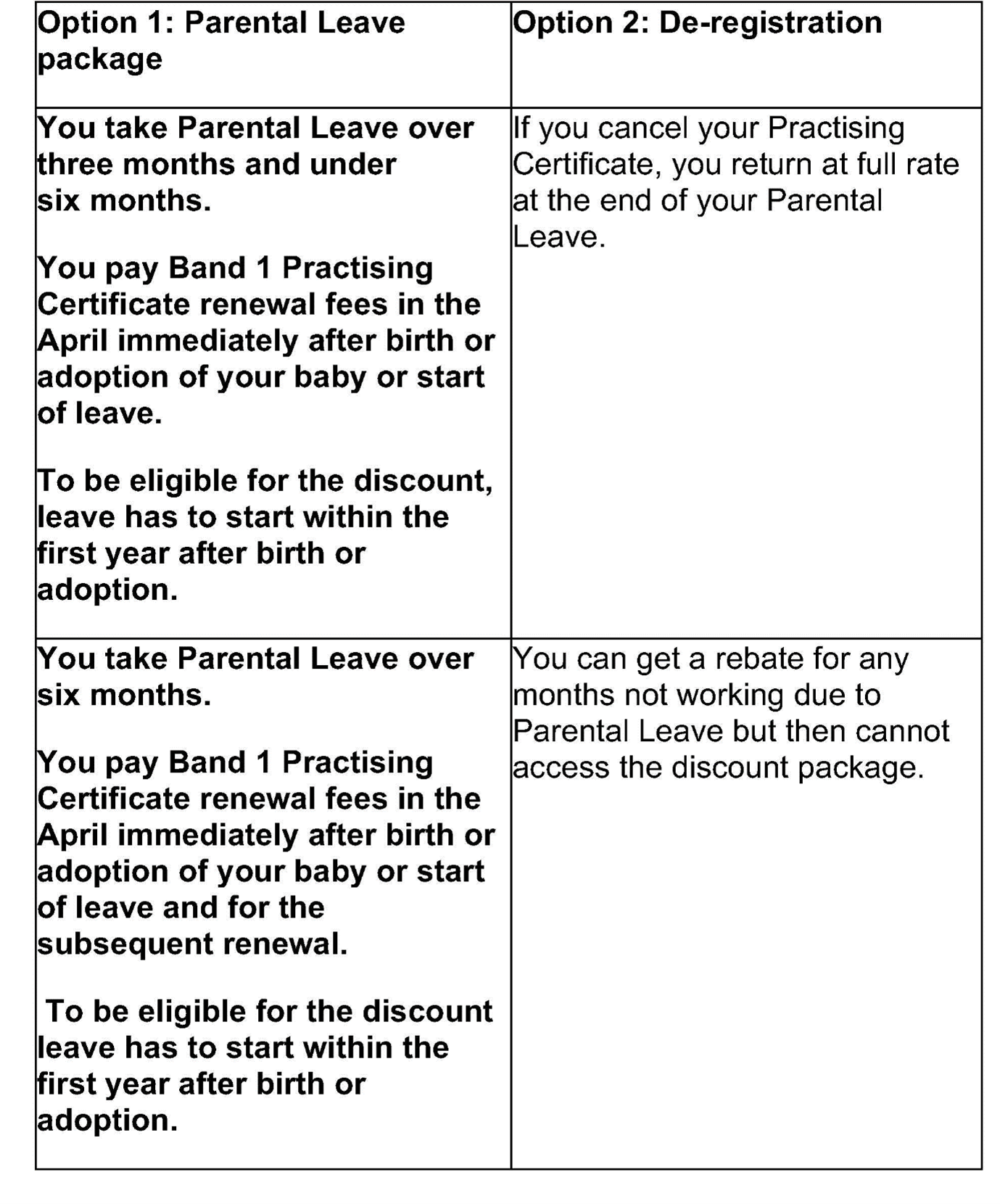

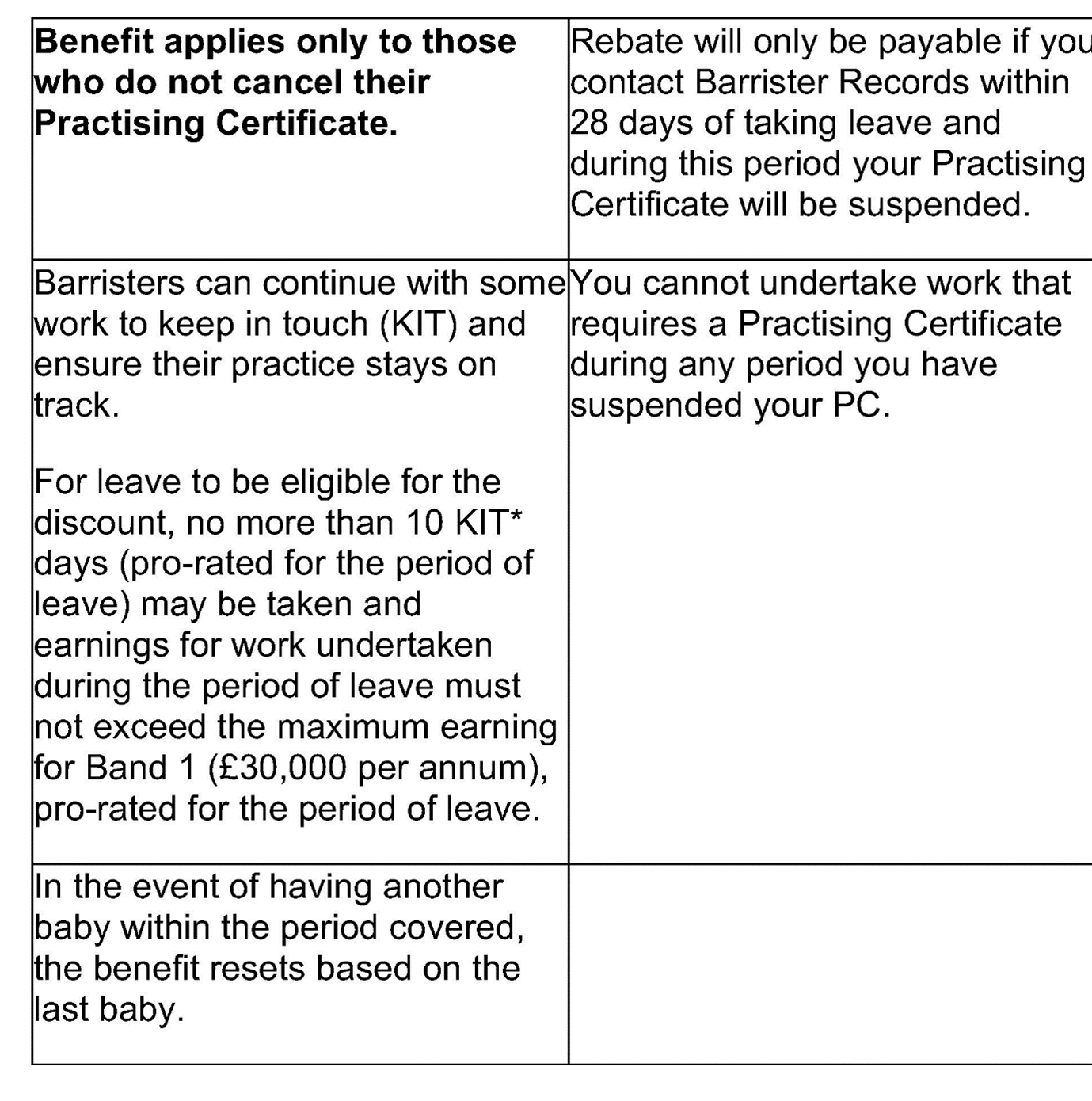

To support barristers returning to the Bar, after a substantial period of Parental Leave, a discount of up to two years on your Practising Certificate is available. During this two-year period, you will pay Band 1 only to maintain your Practising Certificate.

Qualification for this is dependent on (i) the length of time you take for your leave; and (ii) on maintaining your Practising Certificate. Discounts are linked to the date of the birth of your child or the adoption of your child and Authorisation to Practise renewal.

You are encouraged to retain your Practising Certificate during your parental leave to enable you to ‘keep your hand in’/complete Keep in Touch (KIT) days and support your return to practice. If this work results in significant earnings, or exceeds the maximum number of days, this period will not be counted as leave for the purposes of the discount.

Minimum qualifying periods and a cap on the maximum number of days that can be worked during any time allocated as Parental Leave are applied to prevent abuse of the discount by those who only take a relatively short break from practice so there is no substantive effect on a person’s practice.

We have also included a cap on earnings from work undertaken during a period of maternity and parental leave to prevent those whose earnings are not substantially reduced from claiming the discount.

The discount is intended to help those who experience a negative impact on their practice only as a result of absence.

Eligibility: Minimum qualifying periods

(a) One year discount

To qualify for one year of Parental Leave discount (Band 1) on your Practising Certificate you must have taken a continuous period or block of at least three months Parental Leave.

(b) Two years discount

To qualify for two years (Band 1) of Parental Leave discount on your Practising Certificate you must have taken a continuous period or block of at least six months parental leave.

Exclusions

- Cap on maximum number of working days

For any Parental Leave period to qualify for the discount, no more than 10 KIT days (8 hours per day) may be taken during time which is allocated as Parental Leave in a 12 month period.

This is pro-rated for shorter periods.

- Cap on maximum earnings during the period of leave

For any Parental Leave period to qualify for the discount, earnings for work undertaken in the period allocated as Parental Leave must not exceed the maximum earnings for Band 1 (£30,000 per annum, pro-rated for shorter periods).

- Timing of Parental Leave

For any Parental Leave period to qualify for the discount it must commence within 12 months of the birth or adoption.

De-registration

Rather than seeking a discount during Parental Leave, an alternative is to unregister. Then you will be entitled to a pro-rata refund of your Practising Certificate Fee when you go on Parental Leave but you will not be entitled to discounts upon return.

Having another baby

In the event of having another baby within the period covered, the benefit resets based on the last baby.

Summary

There are therefore two options available:

If you have any questions about the application of this policy, please contact [email protected].

To change your practising status, you will need to complete the ”Change my practising status” application via MyBar. This is found under “My practising details”. An example of a change of status is changing from a self-employed capacity to an employed capacity.

You will need to review your practising addresses once you have submitted the application. These will be confirmed at the end of the process.

If you are changing your status, you are required to update your record and inform us of the change within 28 days.

If you are a pupil in your non-practising period you do not need to be authorised to practise, as you are not entitled to do anything that constitutes practising as a barrister.

If you are a pupil in your practising period, you need to have a provisional practising certificate. After submitting (i) a certificate of completion or exemption from the non-practising period and (ii) registering a practising period, you will be issued with a provisional practising certificate. This will be valid for the duration of your practising period.

Once you have completed your pupillage and confirmed this to us, you will be sent details about how to change your status to a practising or unregistered barrister, as appropriate.

If you are a self-employed barrister, an employed barrister in a BSB entity or you practise in a dual capacity, you must notify us of the chambers’/entities’ website addresses on which you offer legal services. If you operate multiple websites for your practice, please provide details of each website.

When completing AtP, you are declaring compliance for the previous CPD calendar year. This means that during the 2024 AtP process you will be declaring compliance for the period 1 January 2023 - 31 December 2023.

If you did not hold a practising certificate during that period, complete the declaration based on the last calendar year you held a practising certificate.

If you have not completed your CPD requirements, you will not be refused authorisation. However, you will be asked to list what action you are taking to remedy this situation. Failure to take further action to comply with CPD requirements may result in you being referred to the Supervision Department.

New practitioners are subject to a three-year New Practitioners’ Programme and therefore should select this option on the declaration. If you are unsure, please contact us using our Contact Form to check.

Self-employed barristers

If you are unable to confirm that you have insurance, you will not be authorised to practise. Please contact BMIF on 020 7621 0405 or email [email protected] to confirm whether you have cover or to arrange cover.

Self-employed barristers practising overseas

Unless you have previously been granted a waiver from this requirement, you are required to hold insurance and be a member of BMIF. Where you hold a self-employed practising certificate, you must be a member of BMIF (under Rule C76.2 of the Code of Conduct in the BSB Handbook).

Government barristers

All barristers are required to complete the insurance declaration confirming that they have and will maintain such insurance as may be required under the Code of Conduct in the BSB Handbook.

If you are a government barrister, you are not required to hold insurance, so compliance with the Code of Conduct in the BSB Handbook for you does not actually require insurance. Therefore, you will be able to complete the declaration without needing to have insurance.

Other employed barristers, providing legal services to their employer only

Although insurance is only required under Rule C76 for barristers who are providing legal services to the public, you will still be required to complete the declaration confirming you have and will maintain such insurance as may be required by the Code of Conduct in the BSB Handbook.

However, in this case, compliance with the Code of Conduct does not actually require insurance. Therefore, if you are only providing legal services to your employer, you will be able to complete the declaration without needing to have insurance.

BMIF categories for practice area information

We use the BMIF categories for practice area information to ensure we have comparable data between the employed and self-employed Bar. We need this to use information about the market for barristers’ services effectively. The self-employed Bar already provide this information to BMIF. Us using the same categories for the employed Bar is therefore the least burdensome approach for the Bar.

Practice area information for in-house barristers

We recognise that some employed barristers may advise on a huge variety of issues, covering most or all of the practice areas listed. Therefore, we have added an additional category for employed barristers - "General".

If you have selected "General", you will also be required to indicate those other BMIF categories which are most relevant. We have defined ”most relevant” as the top three categories, based on the percentage of time spent working in each area.

Requirement for registration

The requirement is for all barristers who have accepted instructions within the last 28 days to work in the Youth Court, or those who intend to do so in the next 12 months. This includes pupils in their practising period (see below).

If you have recently undertaken work in the Youth Court without expecting to do so and have not registered with the BSB to undertake Youth Court work, you should register within 28 days of accepting instructions.

If you are a barrister with a full practising certificate, you can register for Youth Court work through MyBar. If you are a pupil, you can do this by emailing [email protected]

If you require any further information about Youth Court declarations, please contact the Supervision Department by emailing [email protected]

Pupils

When you register for your provisional practising certificate, there will be a question about whether you expect to undertake Youth Court work during the practising period of your pupillage.

You should register with our Pupillage Records Team if you did not make the declaration and subsequently accept instructions for a case in the Youth Court. This can be done by emailing [email protected]

No longer undertaking Youth Court work

You should deregister if you are no longer undertaking Youth Court work and do not intend to do so in future. You can do so through MyBar.

Visit the anti-money laundering webpage for more information.